The integration of Power BI in the banking industry is more than a trend; it’s a necessary evolution for data management and decision-making. Amidst the complexities of financial transactions and big data, Power BI offers banks a pathway to enhanced analysis and improved customer insights. This piece examines the definitive role of Power BI in banking, providing you with a clear understanding of how it empowers data handling and strategic action, without wading through technical jargon.

Power BI's Impact on the Banking Industry

The banking industry has long been a data-rich environment, with every transaction generating valuable insights that can be harnessed for decision-making, risk assessment, and customer relationship management. However, the challenge has always been how to effectively analyze and use this data. Power BI, a business intelligence tool, has stepped in to bridge this gap, providing an efficient way for organizing and reporting financial data without limitations.

Banks are using Power BI to monitor key indicators, analyze large volumes of data, manage financial data, track KPIs, and streamline their services. The result is improved customer insights, operational efficiency, and risk assessment. However, to harness the full potential of Power BI, banks must develop a data analytics strategy aligning with their vision and operate with consulting services tailored to bank-specific needs.

Enhanced Data Analytics Capabilities

One of the key strengths of Power BI is its advanced data analytics capabilities. It can:

-

Process and analyze datasets that exceed 100 million rows

-

Create insightful dashboards and reports

-

Draw data implications from large datasets using the Quick Insights feature

This is particularly beneficial for banks managing extensive data.

Power BI’s built-in time intelligence attribute enables the banking sector to track and analyze data trends over multiple years. Furthermore, through advanced analytics, Power BI aids banks in analyzing customer data to understand preferences, reduce risks, and refine operational efficiency. This deep dive into data analysis has revolutionized how banks approach data management, paving the way for better decision-making and overall performance.

Streamlined Financial Management

Another area where Power BI shines is in streamlining financial management. This tool’s ability to define and reuse measures across multiple reports has revolutionized the reporting of KPIs in the banking sector. By using Power BI, financial management teams can quickly generate reports that used to take months to compile, thereby making informed decisions more rapidly.

Power BI also helps banks consolidate data from various systems into a centralized platform, eliminating the need for separate and potentially inconsistent reports from individual systems. This not only enhances productivity but also provides clarity for finance professionals by incorporating numerous data sources and presenting data components for improved insights.

Key Features of Power BI for Banks

Power BI is not just about data analytics; it’s also about the seamless integration of data from diverse sources and the creation of ergonomically designed reports. Power BI’s dynamic and user-friendly design enhances real-time data analysis over traditional tools like Excel. It enables banks to integrate data from diverse sources, including Excel and Azure, to create actionable financial insights.

Power BI offers ergonomically designed reports that enable secure and efficient access to updated financial information. Furthermore, the reporting process in banking is streamlined through Power BI, accelerating report generation and sharing while upholding security. These features make Power BI an essential tool for banks to analyze and monitor their financial data, utilizing Power BI tools for enhanced analysis.

Exceptional Data Projection Systems

One of the unique features of Power BI is its ‘what-if parameters’ feature designed for interactive data projections. This feature allows financial institutions to create dynamic projections by adjusting underlying assumptions or predictive models. Scenario analysis through ‘what-if parameters’ helps banks in forecasting, budget planning, and assessing the financial impact of potential business decisions.

This ability to create dynamic projections and perform scenario analysis is a game-changer for financial planning and decision-making in banks. It allows banks to explore various ‘what if’ scenarios, enabling them to be better prepared for future uncertainties and challenges.

Interactive Data Visualizations

Interactive data visualizations in Power BI offer another crucial advantage for banks. These visualizations enhance decision-making capabilities by providing insights into data trends and patterns. For example, Power BI supports banks in identifying potential customers by utilizing data visualization to reveal data trends and patterns through interactive dashboards.

Moreover, sales results can be monitored in real-time within Power BI for various dimensions such as:

-

Geography

-

Brand

-

Store

-

Item type

This further assists in strategic decision-making. These interactive data visualizations make Power BI a powerful tool for banks to identify opportunities and make strategic decisions.

Power BI for Customer Engagement Strategies

Power BI’s capabilities extend beyond data analysis and management to enhancing customer engagement strategies. By analyzing customer data, Power BI supports segmentation and personalization, aiding banks in understanding customer needs and improving cross-selling opportunities.

Moreover, the Quick Insights feature of Power BI provides automated analysis that reveals patterns and implications within customer data. This leads to improved customer satisfaction and strategic business goals, thus establishing Power BI as a fundamental tool for enhancing customer relationship management in the banking industry.

Predictive Analytics for Personalization

Predictive analytics in Power BI provide banks with a deeper understanding of customer data, allowing for a more tailored approach to product and service offerings. Financial institutions can drive customer segmentation and personalization efforts to support targeted marketing and the development of customized banking services.

By leveraging predictive analytics in Power BI, banks can forecast customer behaviors and preferences, enhancing their ability to personalize services and foster stronger customer loyalty. The integration with R and Python offers the ability to create custom visualizations, providing financial institutions with tailored insights into customer needs.

Fraud Detection and Prevention

Power BI’s advanced forecasting and fraud detection capabilities play a crucial role in securing banking operations. By integrating machine learning models, Power BI aids in technical integration for fraud prevention. Banks can substantially reduce fraudulent activities and prioritize fraud detection efforts by analyzing transaction patterns and identifying anomalous behavior through visualizations created in Power BI.

The integration of financial data from various sources, such as transaction records, bank statements, and accounting systems, offers a more complete view of fraud detection efforts. Furthermore, continuous monitoring and improvement mechanisms within Power BI assist in refining and improving fraud detection algorithms over time, ensuring up-to-date protection for the banking industry. Analyzing financial statements can also contribute to this comprehensive approach.

Collaborative Features of Power BI

The collaborative features of Power BI are another reason why it’s a favorite among banking professionals. Power BI integrates seamlessly with Microsoft Office 365, promoting efficient workflow management in financial teams. The ability to share interactive reports and dashboards enhances collaboration within finance teams.

Moreover, Power BI offers secure collaboration and real-time updates, empowering finance teams to share financial datasets and communicate effectively. These collaborative features make Power BI not just a tool for data analysis but also a platform for efficient communication and collaboration within finance teams.

Secure Data Sharing

Security is a top concern in the banking industry, and Power BI addresses this by employing a multi-tiered, defense-in-depth security model to ensure industry-leading protection for sensitive data. The service’s architecture includes transparent data encryption and allows organizations to bring their own encryption keys for secure data handling.

Power BI adheres to the Security Development Lifecycle and is compliant with a wide range of security assurance and compliance requirements. The authentication to Power BI services is based on the Microsoft Entra auth code grant flow, ensuring secure sign-in for users. These features ensure that data sharing in Power BI is not just easy but also secure.

Real-Time Updates and Communication

Real-time updates and communication in Power BI enable banks to:

-

Stay on top of their operations

-

Display trends, patterns, and challenges in one place, providing a comprehensive view of the bank’s current position in real-time

-

Monitor and analyze transactions in real-time

-

Set up alerts for transactions that meet certain suspicious criteria

Time-saving automation in Power BI, such as scheduled data refreshes and report distribution, ensures that financial reports are consistently updated in real-time. Automatic data refreshes enable banks to have up-to-date insights, facilitating timely decision-making.

Implementing Power BI in Banking Operations

The implementation of Power BI in banking operations involves several crucial steps. Here are the key steps for the successful implementation of Power BI:

-

Establish a clear data analytics strategy that aligns with the bank’s goals.

-

Collect and prepare the necessary data for analysis.

-

Utilize Power BI’s powerful visualization techniques to gain insights from the data.

Power BI encompasses the complete data processing cycle essential for banking business operations, including data collection, preparation, and powerful visualization techniques.

Developing dashboards with automatic data updates ensures that banking decision-makers have access to the most current information. Customization of Power BI to meet specific banking needs can be effectively achieved through collaboration with trusted Power BI solution providers. Additionally, continuous evaluation and optimization of the Power BI setup is critical for maintaining its alignment with the dynamic goals and environment of the banking industry.

Data Integration and Preparation

Power BI achieves technical integration for banking data through the establishment of data pipelines, customization of connectors, and selection of relevant data sources. Power Query simplifies the sourcing and transformation of data, aiding financial analysts in banks.

Power BI automates data processing, eliminates duplicate data, and constructs accurate reports, reducing the need for manual data management. Using integrated data gathered from multiple sources, Power BI facilitates the creation of banking dashboards to manage data and extract insights.

Custom Dashboard Development

Custom dashboard development in Power BI allows banks to focus on specific KPIs and monitor their performance through a single platform. Power BI enables the creation of interactive dashboards that can be tailored to meet the specific objectives of banks. These dashboards provide visual tracking of financial and operational KPIs such as:

-

Expenses

-

Revenue

-

Operating profit

-

Return on assets

-

Customer satisfaction scores

Customizable dashboards allow banks to focus on particular KPIs relevant to their goals, enhancing their ability to monitor different aspects of performance. The integration of various data sources into Power BI dashboards provides banking professionals with a single platform for real-time performance analysis.

Case Studies: Power BI Success Stories in the Banking Industry

The impact of Power BI on the banking industry is best understood through real-world examples. More than 150,000 organizations have integrated Power BI into their operations, reflecting its wide acceptance in the digital transformation initiatives of various industries, including banking. A prime example of a bank that has successfully adopted Power BI is Metro Bank.

After implementing Power BI, Metro Bank gained the capability to closely monitor key performance indicators such as call center service levels, online banking transactions, and timelines of customer complaint resolutions. The CEO of Metro Bank expressed the benefits of Power BI by metaphorically calling it ‘a bank in his pocket’, indicating the platform’s ease of providing visualized data analysis on the go. Looking ahead, Metro Bank is leveraging the Machine Learning capabilities within Power BI to improve predictive analytics and demand forecasting for projects.

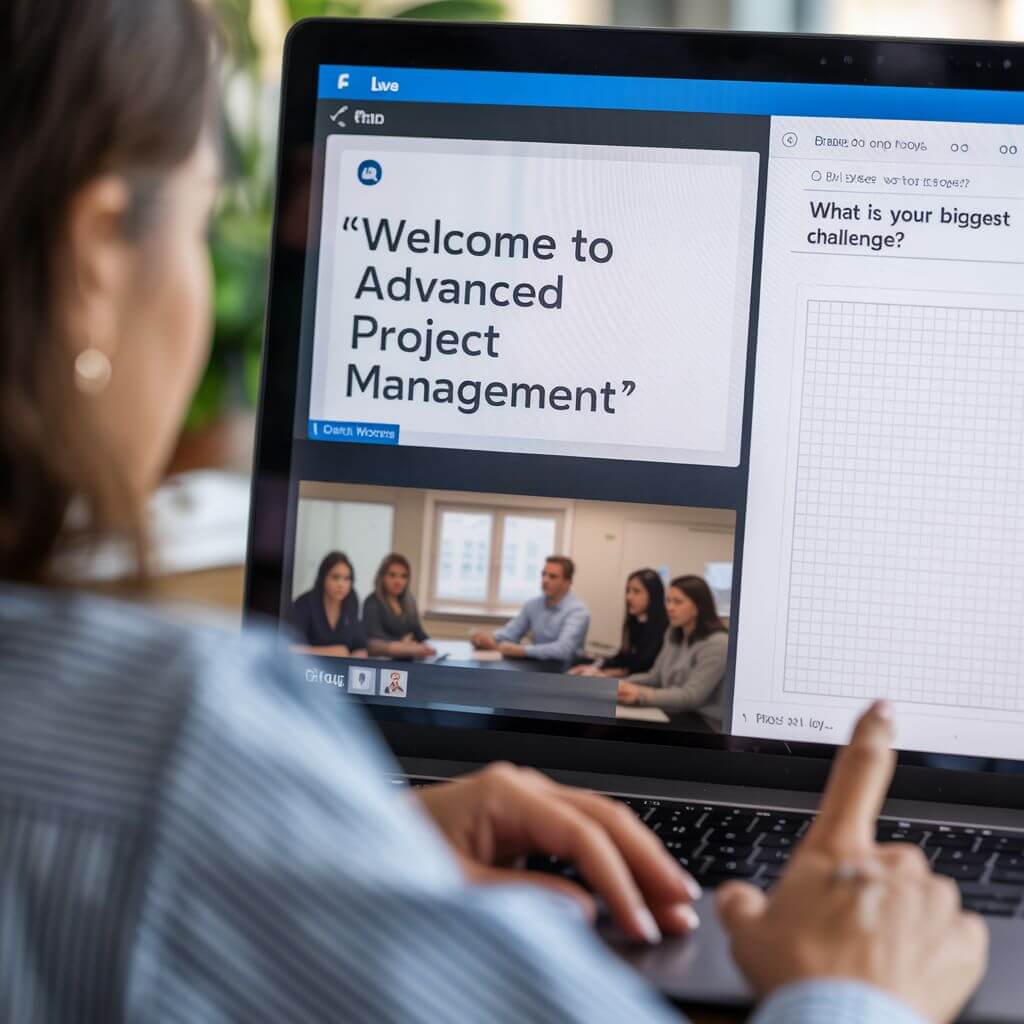

Learn with Nexacu

For banking professionals looking to enhance their skills and knowledge in Power BI, Nexacu can be an excellent resource. As the leading provider of Microsoft end-user training, Nexacu offers high-quality, practical, instructor-led courses. These courses are available in face-to-face classroom settings as well as via remote login.

Nexacu offers in-class, remote, and workplace training across Australia. These courses are designed to provide banking professionals with the skills they need to leverage Power BI effectively in their daily operations, helping them to gain insights from complex financial data and make informed decisions.

Frequently Asked Questions

What is Power BI and how does it impact the banking industry?

Power BI has revolutionized the banking industry by enhancing data analytics capabilities and streamlining financial management, making it easier for banks to gather and analyze data from multiple sources.

What are the unique features of Power BI for banks?

Power BI's exceptional data projection systems and interactive visualizations make it an essential tool for banks to analyze and monitor financial data effectively.

How does Power BI enhance customer engagement strategies in the banking industry?

Power BI enhances customer engagement in the banking industry by enabling predictive analytics for personalization and fraud detection and prevention. This helps banks tailor their services to individual customers and protect against fraudulent activities.

What are the collaborative features of Power BI?

Power BI offers secure data sharing and real-time updates, allowing finance teams to communicate and collaborate efficiently.

How can banks implement Power BI in their operations?

Banks can implement Power BI in their operations by establishing a data analytics strategy, integrating and preparing data, and developing custom dashboards for performance analysis. This will help improve decision-making and operational efficiency.

Australia

Australia New Zealand

New Zealand

Singapore

Singapore

Hong Kong

Hong Kong

Philippines

Philippines

Thailand

Thailand

Indonesia

Indonesia